If you want to increase the potential return on a stock investment, you can leverage your purchase by “buying on margin.” This means borrowing up to half of the purchase price from your broker.

If you can sell the stock at a higher price than it cost, you can repay the loan, plus interest and commission, and keep the profit. But if the stock drops in value, you still have to repay the loan. And if you must sell the shares for less than you paid, your losses could be larger than if you had owned the stock outright.

Setting Up A Margin Account

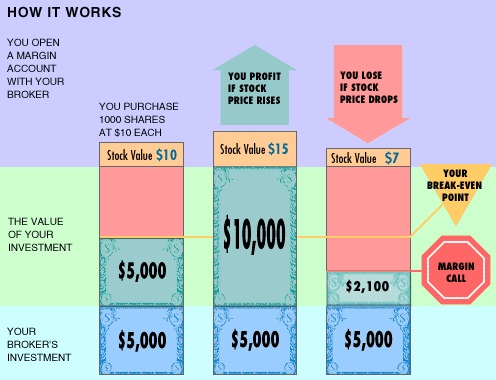

To buy on margin, you set up a margin account with a broker and transfer the required minimum in cash or securities to the account. Then you can borrow up to 50% of a stock’s price and buy with a combination of borrowed and your own funds.

For example, if you bought 100 shares at $100 a share, your total cost would be $10,000 (100 sh x $100 = $10,000). But buying on margin, you put up $5,000 and borrow the remaining $5,000.

If you sell when the stock price rises to $150, you get $15,000. You repay the $5,000 and keep the $10,000 balance. That’s almost a 100% profit. Had you paid the full $10,000 with your own money, you would have made a 50% profit, or $5,000.

Margin accounts should only be used by well-experienced traders/investors that have the proper risk management skills. Some traders use margin accounts because if used correctly, trading on margin offers a number of potential advantages.

Margin Accounts Can Be Risky

Buying stocks with margin can be very risky because both gains and losses are amplified. That is, while the potential for greater profit exists, there is also the potential for greater losses. It’s possible to lose more money than you deposited in the account.

Buying on margin also comes with other fees such as margin interest rate payments for use of the borrowed money. You should always check with your broker to find out how much margin interest rate is.

Margin Account Requirements

Industry rules require that investors have at least $2,000 (the minimum margin) in a margin account before purchasing stocks.

Once shares are purchased on margin, the value of the account must not fall below the maintenance margin. Typically with most brokers, the maintenance margin is 25% of the total market value of the stocks in the account. However, brokerage firms can set their own house requirement which may differ from the maintenance margin.

If the equity in the margin account falls below the house requirement of 25%, the brokerage firm will issue a margin call requiring you to deposit more cash. If the margin call is not met in a timely fashion, the firm may liquidate the position or any stock in your account without your permission.